Nailing a GTM Strategy: A Comprehensive Guide

In a world filled with seemingly endless options, every business has a challenge: How to effectively introduce their product or service to the market and convince customers to choose them over their competitors? Enter the Go-to-Market (GTM) strategy, a crucial map that guides a company’s journey from concept to the customer. It outlines the path a business will take to deliver its unique value proposition to customers, from identifying the target market to detailing how the product or service will reach and benefit the consumer.

But why is a GTM strategy essential? It serves as your company’s blueprint for success, bridging the gap between your business’s strategic objectives and Real-World™ execution. An effective Go-to-Market strategy helps companies align their product, market, and organizational readiness for a successful market penetration. It provides the direction and framework necessary to successfully launch new products, enter new markets, and attract new customers or segments.

What exactly is a GTM strategy, anyway? Why is it of paramount importance to your business? More importantly, how can you devise one that can effectively sail your product or service to its destined customer harbor?

In this comprehensive guide, we delve into the nuts and bolts of GTM strategy, aiming to arm you with the knowledge and tools necessary to chart your path to market success. This is not about following a template, but about asking #TheRightQuestions that will lead you to create a unique, adaptable, and winning GTM strategy.

Defining GTM Strategy

Go-to-Market (GTM) strategy, a term frequently thrown around in the business world but often misunderstood. So, what exactly does it mean? At its core, a GTM strategy outlines the way a company will sell its products or services to customers. It’s the roadmap that guides how your business will reach and satisfy customers, achieve competitive advantage, and ultimately, drive growth and profitability.

A go-to-market (GTM) strategy is a plan that details how an organization can engage with customers to convince them to buy their product or service and to gain a competitive advantage. A GTM strategy includes tactics related to pricing, sales and channels, the buying journey, new product or service launches, product rebranding or product introduction to a new market.”

Gartner

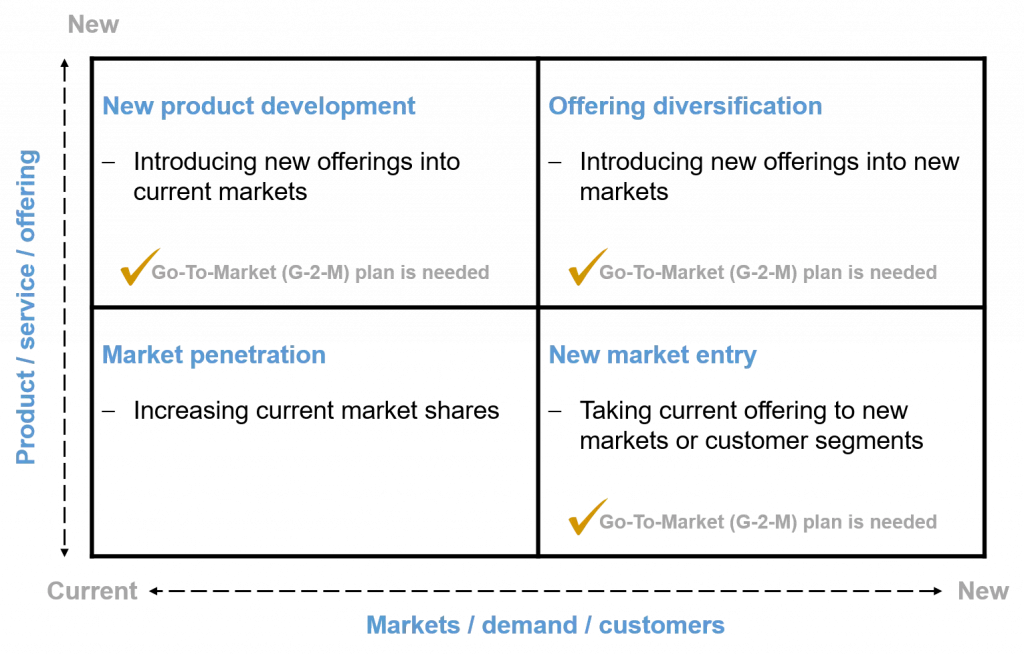

Originally, GTM Strategy was only considered as such, when speaking of new brands, new products or entering new markets. And if we are purists, that is what it is, and would just apply to the situations in the following graph (source):

But, and this is a helluva big but, in VUCA environments (High Volatility, Uncertainty, Complexity and Ambiguity) continuously changing markets, consumer behaviors, technologies, competition, media and channels… Go-to-Market is no longer (if it ever was) something you need to plan only when you are launching. It needs to be in your mind permanently.

Who needs a GTM strategy then? Is it only for large corporations or certain industries? The answer is an unequivocal “No”. Every business, regardless of size, industry, or product complexity, requires a GTM strategy. Whether you’re a startup launching its first product or a mature company introducing trying to adjust to market changes, a Go-to-Market strategy is vital. Why? Because it clarifies your business goals, defines your target customers, and lays out the plan to reach and engage them effectively.

Yet, just having a GTM strategy isn’t enough. You need a strategy that works for your business, and not a template, a copy of someone else’s approach. The question is, how can you develop a GTM strategy tailored to your brand’s unique needs? What are the key components you need to consider? That’s what we explore in the next section.

Key Components of an Effective GTM Strategy

An effective GTM strategy isn’t created in a vacuum. It’s built on a foundation of key components that, when combined, form a comprehensive plan for market success. Here are the crucial elements you need to take into account when developing your GTM strategy:

1. Market Definition and Segmentation:

What does your market look like? These are #TheRightQuestions to start with. It’s important to understand that the market you operate in shapes your entire GTM strategy. Thorough market research and segmentation form the bedrock on which you build your strategy. A nuanced understanding of market dynamics, trends, and key players equips you with the knowledge to identify and seize opportunities. Once you’ve established a broad understanding of the market, market segmentation enables you to narrow down your focus to the most promising customer groups, thereby optimizing resources and enhancing effectiveness.

It’s through market research that you gain a deep understanding of your customers’ needs, wants, and pain points. By understanding the demographic, psychographic, and behavioral characteristics of your market segments, you can craft a GTM strategy that speaks directly to their unique needs and preferences. In other words, you break down the market based into manageable chunks, allowing for targeted strategies.

In conducting market research, don’t just rely on second and third party data; first hand research is equally important. Surveys, interviews, and focus groups can provide firsthand insights into customer behavior and preferences. Furthermore, data analytics tools can help you analyze and make sense of large volumes of data.

In short, thorough market research allows you to craft a GTM strategy that is not based on assumptions but on real, actionable insights.

2. Identifying the Target Customer: Ideal Customer Profile (ICP), Buyer Persona and Buying Center

The next step is defining the ‘Who’ in your GTM strategy. Who is your ideal buyer? Who benefits most from your product or service? What are their needs, preferences, and pain points? By identifying and understanding your target customer, you ensure your GTM strategy is built around the people most likely to buy from you, use your product, and become loyal customers.

In addition to defining your target customer, market segmentation comes into play. Market segmentation, as pointed above, involves dividing a broad target market into subsets of consumers who have common needs, interests, and priorities, and then designing and implementing strategies to target them.

One of this segments, represents your ICP or ideal customer profile. You must understand their needs, preferences, and pain points in depth (much deeper than any other segment), which will ultimately shape your value proposition and your sales and marketing strategies. ICP defines companies, types of businesses. And buyer personas, are who you will be speaking to inside your ICP. A buyer persona is a semi-fictional representation of your ideal customer, based on market research and real data about your existing customers. Personas can include demographic information, behavioral traits, motivations, and goals.

The Ideal Customer Profile (ICP)

The ideal customer profile (ICP) refers to the specific types of companies that would derive the greatest value from your brand’s products or solutions. These companies are considered the ideal buyers for your offerings. It involves identifying the ideal company size, industry, demographics, and other relevant factors, like behavior, able of identifying a company’s readiness to buy from you. By understanding your ICP, you can tailor your marketing strategies and messages to effectively reach and engage these ideal customers.

ICP definition is a strategic decision of the highest business impact and must come from top Marketing and Sales executives and must be actively supported by the CEO and get buy-in from other departments, like Product.

Although ideal customer profiles (ICPs) can be beneficial for various businesses, they tend to be particularly useful for companies engaged in B2B (business-to-business) sales rather than B2C (business-to-consumer) sales.

ICPs are especially valuable for businesses that employ ABM, account-based marketing, strategies, where the focus is on targeting specific accounts rather than attempting to reach all companies that could potentially benefit from their products or services. ICPs help businesses prioritize their resources and concentrate on the accounts that offer the highest potential for revenue and long-term partnerships.

How to define your ICP?

Your ideal customer profiles should reflect actual businesses within your target scope, even if they are not an exact representation of your current customer base.

While ideal customer profiles are fictional and involve some guesswork, it is important to use real data to inform your decisions and make your profiles as accurate as possible.

There are several key attributes to consider when creating your ideal customer profiles, such as:

- industry

- company size

- business model

- estimated revenue

- number of employees

- geographical location

- tech stack

- company pain points

- number of partners

- and more

These attributes will help you understand your target customers better and tailor your marketing and sales tactics accordingly.

To delve deeper into these attributes, you can ask specific questions during the ideal customer profile creation process. Some of these questions may include:

- What is the background of your ideal company?

- How did they start and grow their business?

- What stage of business are they currently in?

- What is their budget for your solutions or products?

- How can your business address the needs of your ideal company?

- What technology do they use and how up-to-date is their tech stack?

By answering these questions, you can gain a deeper understanding of your ideal customers and align your marketing and sales strategies to effectively meet their needs.

The Buyer Persona

A buyer persona is an idealized semi-fictional representation of the person who embodies the characteristics of your target customer. It is created through thorough research on your current or desired customer base to develop a profile that reflects real customers. A well-defined buyer persona helps you understand your customers (and potential customers) better.

Buyer personas provide structure and context for your marketing activities. They guide your messaging, content, and language to resonate with your target audience, enabling you to build stronger connections with customers. Companies often have multiple buyer personas, each representing a different audience segment with similar goals or intentions regarding your brand. Rather than creating a persona for every job title, it’s more effective to focus on common challenges and the solutions your business can provide.

Always, always, always base it on behavior. Demographics can be there too, to better paint the picture, but the real key and essential data to getting your Buyer personas right, is behavioural data, not demographics.

Building a buyer persona involves extensive research into the individuals who make purchase decisions for your brand, whether end consumers or decision-makers in ideal companies. It requires understanding the key decision-makers and target individuals for your messaging. A well-developed persona includes demographic information, personality descriptions, behavior analysis, and professional goals. The more comprehensive the profile, the better you can personalize marketing messages and campaigns to address specific pain points or goals within your target audience.

Key attributes to consider when building a buyer persona include:

- goals

- challenges they face

- what and how do they prioritize in life and work

- description

- job title

- salary

- personality traits

- education level

- professional background

- pain points

- attitudes and beliefs

- age

- gender

- professional and personal goals

- experience with technology

- professional obstacles

- potential objections.

To better understand your buyer personas, ask yourself questions that help visualize them as real individuals, even though they are semi-fictional representations. Some questions to consider include (depending on the product you sell, obviously):

- What is their dream job?

- What makes him proud in his role?

- What are their hobbies and interests outside of work?

- How can your products or services solve their pain points?

- Why would they choose you over a competitor?

- Where do they spend their time online?

By answering these questions and creating detailed buyer personas, you can gain deeper insights into your target customers and develop more effective marketing strategies that resonate with their needs and preferences.

Understanding the types of businesses you want to target is where your ICP comes in. But it’s important to remember that deals are made between people, not just organizations. That’s why your buyer persona is invaluable. It helps you create messaging and marketing tactics that speak directly to the individual stakeholders and decision-makers within your target businesses.

By combining your ICP and buyer persona, you can develop a holistic marketing strategy that resonates with the human side of your target audience while aligning with your business objectives. After all, connecting with people on a personal level is key to building successful relationships and closing deals.

When it comes to understanding customer segments, you must separate ideal customer profile (ICP) and buyer persona. While these terms are sometimes used interchangeably, it’s important to note that they are not the same.

The Buying Center

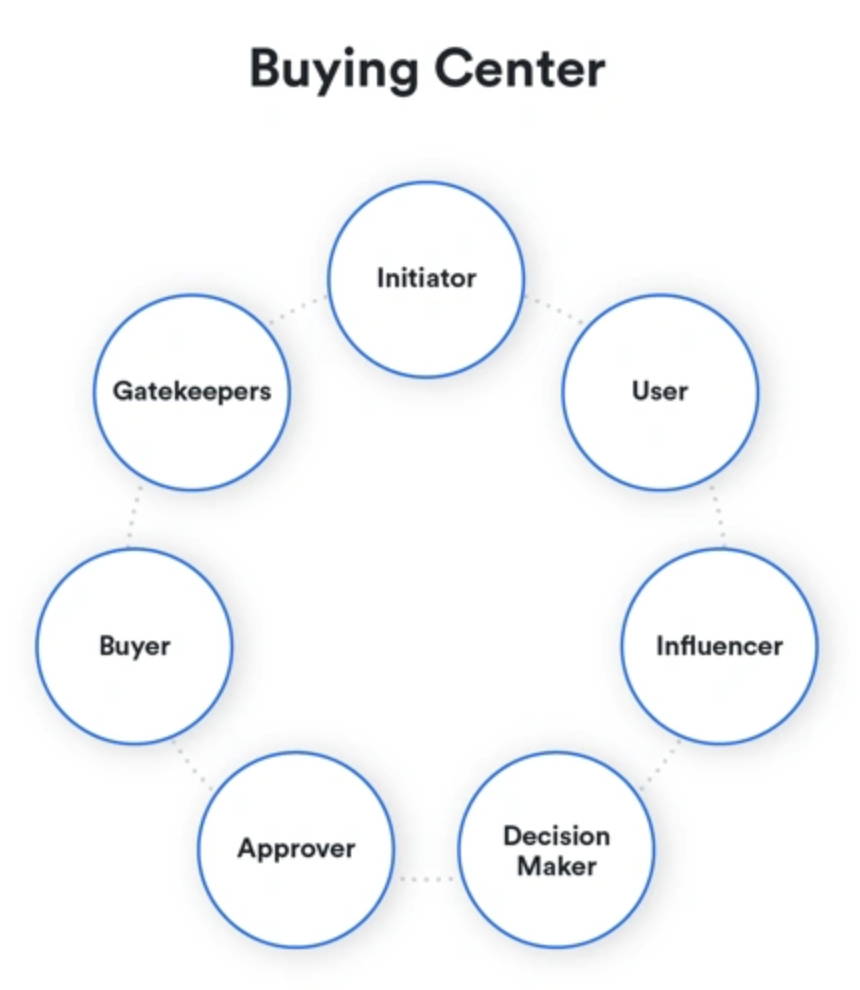

The “Buying Center” is the tool we use to recognize and identify the key decision-makers involved in the B2B buying process. Then, you create the Buyer Personas based on this specific Buying Center.

When launching your product in the market, it’s essential to understand your customers and the individuals who play a role in the purchasing decision. According to Gartner, a typical buying group for complex B2B solutions consists of 6 to 10 decision-makers, collectively known as the “buying center.” Each member of the buying center comes equipped with their own set of four or five independently gathered pieces of information, which may need to be reconciled within the group.

Within this buying center, each individual assumes a specific role, although some job titles may overlap (source of image and list of roles):

- Initiator: Starts the buying process or expresses initial interest.

- User: Regularly uses your product.

- Influencer: Persuades others about the need for the product.

- Decision maker: Provides approval for the purchase.

- Buyer: Manages the budget and financial aspects.

- Approver: Holds the authority to give the final go-ahead, often a high-level executive.

- Gatekeeper: Acts as a barrier to product implementation or approval.

To build an effective go-to-market strategy, it’s crucial to identify the members of the buying center and their respective personas. This will vary depending on your product, industry, and target market. Gather your team and brainstorm the job titles that may be impacted by your solution.

Conduct thorough research on each role to gain insights into their responsibilities, goals, and pain points. Understanding who these individuals are, what drives them, and the challenges they face is vital, as they will be instrumental in driving the success of your product.

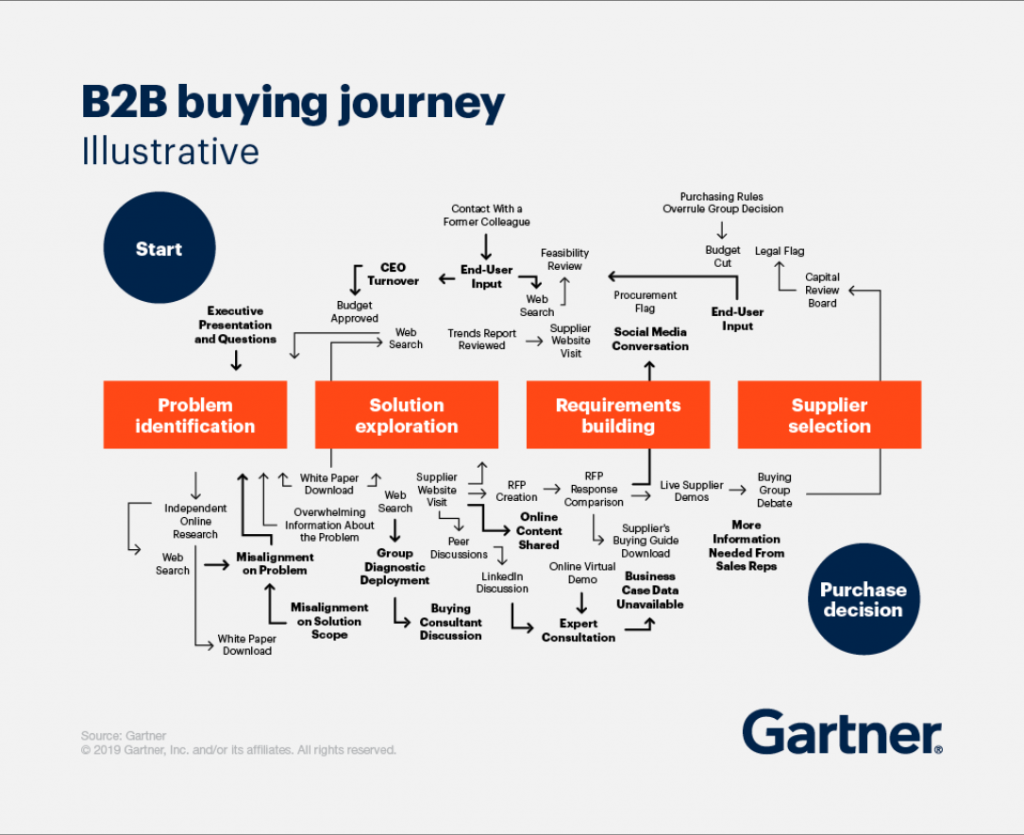

The next step, or actually, a step taken in parallel, is understanding how these roles typically interact, to be able to plan accordingly. To ensure a successful purchase, Gartner research has identified six essential “jobs” that B2B customers need to fulfill. These jobs help customers navigate through the complex purchasing process and achieve satisfaction before making the final decision:

- Problem identification. “We need to do something.”

- Solution exploration. “What’s out there to solve our problem?”

- Requirements building. “What exactly do we need the solution to do?”

- Supplier selection. “Does this do what we want it to do?”

- Validation. “We think we know the right answer, but we need to be sure.”

- Consensus creation. “We need to get everyone on board.”

Unfortunately, the B2B buying journey is not a straightforward, linear process. Instead, customers engage in a looping pattern throughout the typical B2B purchase, revisiting each of the six buying jobs multiple times.

These buying jobs do not occur in a strict sequence but rather happen simultaneously or in overlapping stages.

The continuous looping and movement between different buying jobs highlight the importance for buyers to have suppliers who facilitate and simplify the purchase process for them.

Customers who perceived the information they received from suppliers to be helpful in advancing across their buying jobs were 2.8 times more likely to experience a high degree of purchase ease, and three times more likely to buy a bigger deal with less regret.

Gartner Study

In essence, defining the ‘Who’ in your GTM strategy is all about understanding your customers intimately. It’s about asking #TheRightQuestions to uncover their needs, their preferences, their pain points, and their behaviors. The insights gained from this process inform all other aspects of your GTM strategy, ensuring it’s customer-centric and tailored to the people who matter most – your customers.

3. Analyzing competition

When building a GTM strategy, an often overlooked yet vital aspect is that competition doesn’t just pertain to your direct competitors; it’s also about the broader competitive landscape which includes substitute products and alternative solutions that your potential customers might opt for. For instance, if you’re a new gym owner, your direct competitors are other gyms in the area. Still, your indirect competitors could be home workout programs or outdoor activities.

The essence of competitive analysis is not merely about knowing who your competitors are but understanding their actions and strategies. How are they pricing their products? What marketing channels are they utilizing? What are their unique selling propositions? How do customers perceive them? By understanding this, you can carve a niche for your product in the market where it shines the most.

An effective competitive analysis can reveal opportunities for differentiation – to distinguish your offering in ways that are valuable to your target customers. It can also highlight industry trends and expose threats that could impact your business. It’s not about “defeating” the competition but learning, adapting, and finding your unique space. You need to analyze competition in general, of the whole addressable market, and specifically of your ICP which might differ significantly.

Competitive analysis is a continuous process and should be revisited regularly as market conditions change and competition often innovates. By maintaining an up-to-date understanding of your competitive landscape, you can adjust your GTM strategy to leverage your strengths, improve your weaknesses, seize opportunities, and neutralize threats.

To effectively differentiate your product in the next step, it’s important to analyze the messaging used by your competitors and how they present their products. This will help you identify your unique selling proposition (USP) and determine how to reposition against the offerings of your competitors. By understanding their messaging, you can find ways to stand out and highlight the unique value your product brings to the market.

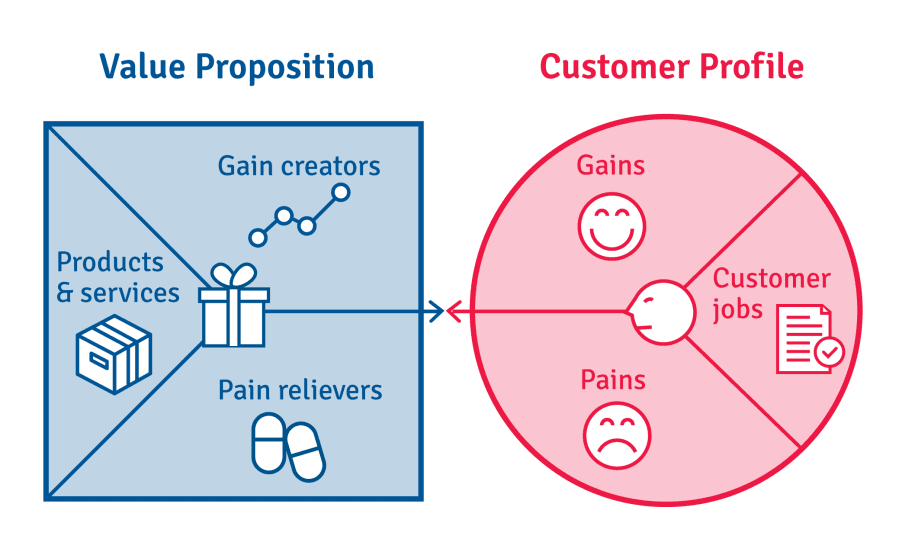

4. Creating the Value Proposition, Customer Journey and Define positioning

Now that you know your customer, what unique value can you offer them? Your value proposition should clearly communicate how your product or service solves customers’ problems, delivers specific benefits, and why it’s better than the alternatives.

Creating a compelling value proposition is both an art and a science.

At its core, a value proposition communicates the number one reason why a product or service is best suited for a customer segment. Which means, that there can be different Value Propositions for different segments.

So, how do you craft a compelling value proposition? You start by answering #TheRightQuestions:

- What problem does your product or service solve?

- Who benefits the most from your solution?

- How does your product or service solve the problem?

- What makes your solution different or better? Here, you define your unique selling proposition — what sets your product or service apart from the competition.

The best way to approach this, is using the Value Proposition Canvas framework.

As you craft your value proposition, remember that it’s not just about what your product or service does. It’s about the outcomes and experiences your customers can achieve. Your value proposition should be clear, concise, and compelling. It should quickly communicate your product’s unique value and make a persuasive case for why the customer should choose your product or service over others.

A well-crafted value proposition forms the backbone of your GTM strategy, guiding your sales and marketing efforts, and shaping your product development. It forms the basis of the messaging throughout your customer journey and ensures that all your efforts are aligned towards delivering this promised value. Get inspired with these examples of value propositions.

The customer journey should reflect this value proposition at every stage, addressing specific pains and gains. Putting all of the above together, the perfect positioning for your brand and product, should emerge with more or less clarity.

Now is the moment to dive into the messaging. And the messaging, is nothing but the accumulated learnings from the work described, distilled to communicate the value of your product or service to your ICP in a way that resonates with their pain points. You need to create a value matrix of specific messages defined for each stage of the Customer Journey, addressing pains/gains, reason and emotion and you need a different one for each buyer persona. If you are into optimizing you ABM Strategy, you’ll need to complete this exercise for each account in your 1-to-1 segment too.

5. Setting the Pricing Strategy and Pricing Model

One of the most challenging aspects of creating a successful GTM strategy lies in defining your pricing strategy. It’s a delicate balance that involves weighing your customer’s perceived value of your product against your desired profit margins and competitive landscape. And yet, in mi experience, in pricing usually lies one of the greatest opportunities for revenue growth. Often, prices and packaging havem’t changed in many years and its not strange to find out comapnies are leaving lots of money on the table on this side.

Being as important as it is, still companies dedicate an average of only 6 hours to getting pricing right.

But first things first: What is the difference between Pricing Strategy and Pricing Model? A pricing strategy is the way you set the price. A pricing model is a kind of price format – it’s part of the way you package and present your goods and services to the customer. The pricing model is a part of the Pricing Strategy.

The 8 Best Known Types of Pricing Strategy

The ultimate goal of your pricing strategy should be to maximize your profits while still offering a value proposition that your customers find attractive. To do this, you’ll need to consider several elements, like analyzing market trends, understanding customer price sensitivity, and considering cost factors and desired profit margins.

With comprehensive insights into buyers and the market, your pricing strategy should align with the gathered information. Here are some pricing strategies to consider:

- Value based pricing: is a customer-centric strategy that sets a price for a product or service based on the perceived value it offers to customers and the amount they are willing to pay for that value. Takes into consideration the specific wants and needs of the target audience.

- Premium strategy: Set higher prices than your competitors to emphasize perceived value. Ensure your packaging, marketing efforts, and content support a high-end product positioning.

- Initial low pricing for market penetration: Enter the market with lower prices to grab attention and gain market share. Although this may result in lower short-term profits, increased awareness can lead to greater long-term profitability.

- Constant low pricing: Adopted by companies with high sales volumes, who keep their costs and marketing expenses low to consistently offer lower-priced products.

- Price skimming: Initially set a high price at product launch and gradually lower it to attract different customer segments. This approach aligns with the technology adoption curve and can generate high returns for new products, establishing a market trend.

- Bundled pricing: Group products together and offer them at a lower price. McDonald’s Happy Meal, which combines burgers, drinks, and fries at a discounted price compared to purchasing them individually, is an example of bundled pricing. Customers perceive bundled offers as providing more value for their money.

- Dynamic pricing: involves adjusting prices in real-time based on supply and demand fluctuations. This approach ensures that prices align with the current market conditions and availability of products or services.To implement dynamic pricing effectively, an algorithm is utilized to automatically modify prices according to purchasing activity.

- Cost-plus pricing: also called markup pricing, involves calculating the expenses incurred by your business and then adding a percentage on top. To arrive at the final price, you need to sum up the costs associated with development, staff, and acquiring customers (CAC). For instance, if the total expense for designing and marketing your software is $100, you can set a price of $150 to ensure a consistent profit.

By selecting the right pricing strategy based on your market research, you can effectively position your products and appeal to the target audience.

The 6 Types of SaaS/Subscription Pricing Models

This section is subscription focussed, which I believe is the most relevant use-case for this post’s audience.

When it comes to subscription or SaaS pricing, there are several models to choose from. Each model offers its own benefits and considerations, so you can select the one that aligns best with your business needs. Actually, it is easy to find models that combine 2 or more of this models. Let’s explore the most commonly used SaaS pricing models:

- Flat-rate pricing: This straightforward model charges a fixed price for a service with the same features. It works well for simple products and niche markets, but can limit growth opportunities.

- Usage-based pricing: With this model, customers pay based on their actual usage of the software. It offers flexibility and helps manage costs, but predicting revenue can be challenging.

- Pay per-user pricing: This model charges based on the number of users accessing the software. It is commonly used by B2B SaaS companies and can be divided into user-based or active-user pricing.

- Tiered pricing: In this model, the software is offered in different packages or tiers with varying features and pricing. It provides options for customers and facilitates upselling.

- Freemium pricing: This model offers a basic version of the software for free, with premium features available at an additional cost. It helps onboard customers and allows for easier upselling, but churn rate can be higher.

- Feature-based pricing: With this model, customers pay based on the specific features they need. It supports customer growth and customization, but requires a deep understanding of your product and customers.

Each pricing model has its own pros and cons, so consider your target market, product complexity, and growth goals when making your decision. If you want to deep dive more into each of these models, I recommend reading Your Comprehensive Guide to SaaS Pricing Models .

6. Crafting Marketing & Sales Strategy

The next step in the journey is to devise a sales and marketing strategy that reaches, engages, and converts your target customers. How will you promote your product or service to your target customers? What channels are the best for each buyer persona in each moment of the journey to conversion? What sales strategy will you use to convert them? From inbound marketing to direct sales efforts, this integrated strategy should be tailored to your customers’ journey and touchpoints.

The 7 Go-To-Market Motions

Conquering the market can be faced from 7 different GTM motions (described by GTM Partners) and each approach requires its unique strategy and investment to drive efficient growth. Many companies combine multiple approaches simultaneously to maximize their results.

As businesses scale, they often adopt different Go-To-Market motions for different market segments. For example, running an outbound motion for a high-velocity small business segment requires a different approach than targeting the enterprise segment. This is because the team’s skills, product offerings, messaging, buyer personas, and sales processes may vary significantly, demanding distinct strategies and investments. It is essential to evaluate whether the existing team can handle an additional GTM motion or if additional resources (budget, teams, processes, plays) are necessary.

When selecting GTM motions, the objective is to discover the most effective path to generate revenue. The only constraint on the number of GTM strategies is your available resources and ability to execute them effectively in alignment with the market’s requirements.

Creating a comprehensive GTM Motion strategy is an intricate process that requires attention to detail in numerous areas. Covering all aspects of marketing and sales strategy would demand a separate set of extensive articles. Therefore, within this piece, we wont get into the specific areas to execute those GTM Motions like inbound marketing, brand awareness, PPC, ABM, demand generation, or lead nurturing to name a few.

Just because it is very relevant when talking about GTM Strategy, allow me to hand-pick Channel-led motion to dive a bit more into it:

Channel-Led: Channels & Partnerships

In the broader perspective of GTM strategy, choosing the right channels and partners is fundamental to your success. Your channels essentially act as your ‘routes’ to the market, and these can vary greatly across businesses. They can be direct, such as your company’s website or sales team, or indirect via retailers, resellers, or affiliates.

Selecting the right distribution channels requires a keen understanding of your target customer. You need to meet your customers where they are – both physically and digitally. Let’s consider the case of a B2B software company. They might opt for direct sales through their website for small businesses, while using a dedicated sales team for larger enterprise clients. They may also use strategic partners to access new markets or segments.

To develop an effective channel strategy, it is important to address key questions:

- Where do the target customers prefer to make their purchases? Are they more inclined to buy online or in physical retail stores?

- Do they require a demonstration or trial before committing to a purchase?

- Does the nature of the product align with the chosen channel? For example, if you are selling a technology product, customers may want to test it in a software environment or review its features before making a final decision.

- What level of customer interaction is necessary for the purchase decision?

- Is partnering with other businesses an option? If so, it is crucial to choose reliable partners who can deliver a consistent brand experience to customers, ensuring they receive the same quality and service as if they purchased directly from your company.

- Where can you differentiate yourself from competitors? Evaluate the approaches taken by your competitors and identify areas where you can gain a competitive advantage. This could involve offering unique value propositions, superior customer service, or innovative marketing strategies.

Strategic partnerships can add another dimension to your GTM approach. For instance, co-marketing partnerships can help expand your reach and visibility, while strategic alliances can allow you to leverage complementary strengths and capabilities. Collaboration with influencers and thought leaders in your market can help you gain credibility and engage potential customers more effectively.

The channel strategy within the Go-To-Market plan involves identifying and engaging with strategic partners who can contribute to the success of the channel. These partnerships go beyond transactional sales metrics and focus on building strong relationships based on trust, mutual understanding, and collaboration towards a common objective. While selecting channels and partners, consider their alignment with your target customers, business objectives, and brand image. Also, it’s essential to evaluate and monitor their performance regularly.

Sales Strategy

Secondly, let’s focus on Sales. Your sales strategy is an integral part of your GTM plan, and it encompasses a range of elements that cannot be covered in a sub-section of this article. Starting from hiring and training the right sales team, developing a comprehensive understanding of your target customers, to crafting compelling sales scripts, every aspect plays a significant role. So let me address only a high level view of the most common sales strategies you might choose to use.

Not all products or markets can be approached with the same sales strategy, so it’s crucial to evaluate the complexity, scalability, and cost of your specific product.

Typically, there are four go-to-market sales strategies that cater to different product types and business models. These strategies provide different approaches to reach your target audience effectively:

The Self-Service Model

The self-service approach occurs when customers make purchases independently. This is commonly observed in B2C transactions, where customers can locate and buy products through websites such as Netflix or Amazon, but also it is incrasingly popular in B2B markets.

This approach is most suitable for straightforward products that are affordable and have high sales volume. Although it is challenging to establish, a successful self-service model offers a short sales cycle, eliminates the need to hire salespeople, and generates substantial profits.

While a sales team is not required, a powerful marketing team is necessary to drive traffic and conversions to your website. The core marketing team would typically consist of experts in growth marketing, performance marketing, and content marketing, along with other team members.

The Inside Sales Model

The inside sales strategy involves nurturing prospects by sales representatives to secure deals. This model works best for moderately complex products with a moderate price range. Although we tend to see how the B2B industries are comfortably moving towards higher deals managed under this model.

The sales cycle for this strategy ranges from a few days to several months. In this case, investing in a sales team is necessary, although inside sales representatives are less expensive than field representatives.

With a high volume of sales, this model can be profitable and relatively easy to establish and expand as more team members are hired.

The Field Sales Model

The field sales approach requires a comprehensive sales organization to close large enterprise deals. Typically, these deals involve complex products with high price points, resulting in a lower volume of deals and a longer sales cycle.

The sales team in this approach is often costly due to experienced field representatives who earn high salaries. While this model is easy to establish, scaling it can be challenging and requires time and financial investment to hire and train a full sales organization.

The Channel Model

Lastly, as mentioned in the previous section, the channel strategy involves enlisting an external agency or partner to sell your product on your behalf. Building this model can be difficult, as finding and educating suitable individuals about the benefits of your product can be challenging. Moreover, external agents may not be as motivated to sell as your own sales team.

However, this model is cost-effective since you do not need to maintain your own sales team. It works best when your product aligns with the interests of the partner. For example, if you sell phone cases, partnering with retailers who sell phones, would be beneficial.

These strategies can be combined and adapted based on the industry or the size of the customer base. For startups, it is advisable to gradually scale over time rather than investing in an expensive sales team too early.

7. Planning for Customer Success & Retention

Don’t let the fact that this is numbered 7th in this list fool you, this is arguably the most important point for SaaS or any other subscription business: how will you ensure your customers are satisfied and stay loyal to your brand? This involves planning for customer onboarding, support, success, and retention strategies. The end goal should be not only to acquire customers but also to build strong, long-term relationships with them.

Focusing solely on the top of the funnel without considering post-sale customer experience can lead to a leaky bucket situation, where you’re losing customers as quickly as you’re acquiring them. That’s why customer success and retention are pivotal for the sustainability and growth of your business.

A customer-centric business understands that the customer journey doesn’t end with a purchase; rather, it marks the beginning of a long-term relationship. The goal of customer success is to help customers derive the maximum value from your product or service, aligning their success with your success.

This starts with onboarding. A well-structured onboarding process can set the stage for the customer’s entire journey with your business. It involves educating customers about your product, helping them integrate it into their workflows, and setting them up for success. It’s your chance to demonstrate value early on, build trust, and lay the foundation for a lasting relationship.

Customer support, on the other hand, is about being there for your customers when they need you. It involves addressing their concerns, resolving their issues, and continuously improving their experience. Excellent customer support can turn unhappy customers into loyal advocates and is crucial for retaining customers in the long run.

But the key is to not just be reactive but also proactive in ensuring customer success. This involves regularly checking in with customers, understanding their evolving needs, and finding ways to add value. It could be through new features, personalized content, or upselling and cross-selling opportunities.

Finally, don’t forget to measure and track customer success. Key metrics could include churn rate, customer lifetime value (CLV/LTV), Net Promoter Score (NPS), and customer satisfaction (CSAT) score. These metrics provide valuable insights into how well you’re retaining customers, how profitable these customers are over time, and how likely they are to recommend your product or service to others.

By focusing on customer success and retention, you’re not just boosting your bottom line but also building a community of loyal customers who can become your brand advocates. Next, let’s bring all these elements to life with some real-life examples of GTM strategies in action.

8. GTM Strategy in Action: Case Studies

To solidify your understanding of GTM strategy, it’s often helpful to see it in action. Let’s explore five examples of successful go-to-market strategies from different industries, and distill the key lessons from each. Due to the already massive length of this post, I’m just going to mention these cases, but I encourage you to research more about them, they are very interesting examples of both their initial GTM launch strategy and how their GTM has evolved in time.

1. Slack – The Business Communication Platform

Slack’s go-to-market strategy was unique because it focused on bottom-up adoption. Rather than targeting executives, it offered its product to teams for free. As more people started using Slack and experiencing its benefits, they naturally advocated for it within their organizations. This organic word-of-mouth marketing helped Slack rapidly expand its user base.

Key Takeaway: Consider a product-led growth strategy, particularly for SaaS products. Providing a free, high-quality product can spur organic growth and create brand advocates.

2. Airbnb – The Home-Sharing Platform

Airbnb’s go-to-market strategy transformed the travel and hospitality industry. It successfully identified a segment of travelers looking for unique, local, and affordable accommodation experiences, a niche that traditional hotels weren’t catering to. Airbnb also provided a platform for homeowners to monetize their unused spaces, creating a win-win situation. To build trust, Airbnb implemented a robust review and verification system, ensuring the safety and quality of the listings.

Key Takeaway: Leveraging underutilized resources and creating a platform that benefits both sides of the market can lead to disruptive innovation. Trust-building measures are crucial in industries where safety and quality are paramount.

3. Stripe – The Online Payment Processor

Stripe’s go-to-market strategy focused on making online payments seamless for internet businesses and individuals. At a time when setting up online payments was a complex process, Stripe offered a developer-friendly, easy-to-integrate solution. Its product-centric GTM strategy focused on addressing the pains of a specific niche: developers and startups.

Key Takeaway: Address the specific pain points of your target audience. A product-centric GTM strategy can help you dominate a niche market.

4. Zoom – The Video Conferencing Tool

Zoom’s success can be attributed to its user-friendly design and reliable service. While other tools were difficult to set up or had unreliable connections, Zoom offered a simple, dependable solution. It also offered a freemium model, which allowed users to try the product before committing to a paid plan.

Key Takeaway: Simplicity and reliability can set you apart from the competition. A freemium model can reduce the barrier to entry and drive adoption.

5. Uber – The Ride-Hailing App

Uber revolutionized the taxi industry by offering a convenient, affordable alternative to traditional cabs. Its go-to-market strategy focused on creating a two-sided marketplace for riders and drivers and pinpointing the pains caused by the alternative: cabs. Uber aggressively expanded into new markets, often subsidizing rides to gain market share.

Key Takeaway: Disruptive innovation can create new markets. Rapid, aggressive expansion can help you gain a foothold in these markets.

Each of these companies approached their go-to-market strategy differently, but they all started by asking the right questions. They understood their markets, identified their target customers, and crafted compelling value propositions to serve them.

Conclusion

Creating a successful go-to-market strategy involves deeply understanding your market, customers, competitors, and your unique value proposition. It requires making strategic decisions about your pricing, sales and marketing, distribution channels, and customer success strategies.

There is no one-size-fits-all GTM strategy. The best strategy for your business will depend on a myriad of factors, including your industry, product, market conditions, and customer needs. So, as you embark on this journey, remember to ask the right questions. Challenge assumptions, learn from others, but ultimately, craft a GTM strategy that aligns with your unique circumstances and goals.

Now, equipped with this knowledge and inspiration, it’s time for you to start crafting your go-to-market strategy. Remember, the path to success is often not a straight line. It requires continuous learning, adaptation, and innovation. But with a robust GTM strategy in place, you’re one step closer to turning your vision into reality.

Good luck on your journey, and remember: keep asking #TheRightQuestions!